An outstanding level of convenience for everyday accounting work.

Not only that, APplus finance and accounting will make your life easier. The enterprise software simplifies everyday work in accounting and enables your controller to set up a perfect information system. You will be amazed at how much time this function saves you week after week.

Sparen Sie Zeit in der täglichen Arbeit – Woche für Woche.

Components for finance and accounting

- Financial accounting

- Cost accounting

- Asset management

- Payroll accounting

- Key figure systems

APplus stands the test for highest requirements

The requirements for quality, transparency and currency of data in business management are increasing constantly. Basel II or new accounting regulations such as IAS/IFRS are only the tip of the iceberg. It is not just a matter of reproducing and representing operational value flows accurately. Planning, continuous monitoring, and variance analyses play a much more important role. The APplus modules for finance and accounting are the right tools for mastering these tasks.

With the APplus finance and accounting module, we rely on the solutions from CSS AG, which has been specialized in the areas of controlling, accounting and human resources for over thirty years. eGECKO from CSS AG is fully integrated into APplus. APplus uses workflows to transmit relevant data about payables and receivables to eGECKO for further processing in the accounting area.

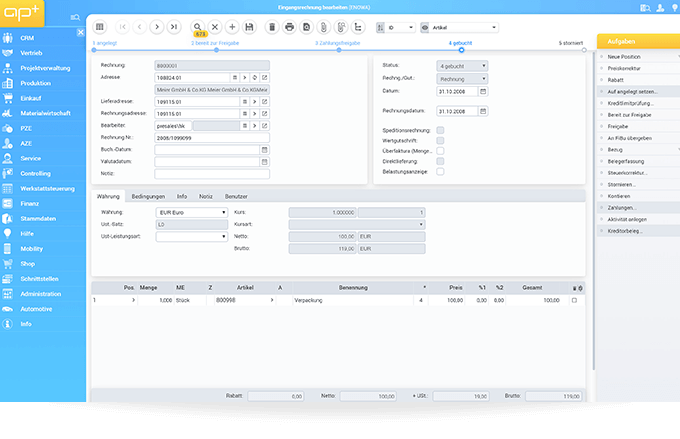

Information about incoming and outgoing invoices flows from the accounting department directly into APplus. A credit limit check function reconciles the data with those of existing customer accounts and evaluates open items in financial accounting. In purchasing and sales, information about down payment and final invoices is given special consideration.

Financial accounting

Establishing credible liquidity arrangements and operational risk management is important for fulfilling Basel II criteria. A particularly interesting feature of the module is the ability to check the posting system for data consistency and logical coherence. Of course, APplus also covers information provisioning in line with the GPDdU (Principles of Data Access and Auditing of Digital Documents) as standard.

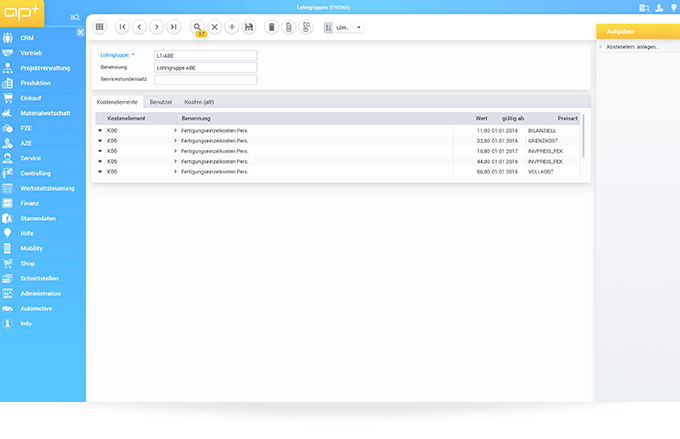

Cost accounting

Im Bereich der Kostenrechnung werden die Grundlagen für eine korrekte innerbetriebliche Leistungsverrechnung sowie für eine perioden-, auftrags- und projektbezogene Erfolgsrechnung gelegt. APplus deckt sowohl Funktionen der klassischen Kostenrechnung als auch des operativen Controllings ab. Insbesondere Simulationen als Grundlage für Plananpassungen und Vorschaurechnungen können Managemententscheidungen wirkungsvoll unterstützen – sowohl im – im Kostenstellen-, Kostenträger- und im Kostenarten-Controlling. Darüber hinaus werden im Ergebnis-Controlling Artikel- und Kundenergebnisse transparent und in der Unternehmenserfolgsrechnung konsolidiert.

Payroll

All payroll-related tasks are completed quickly and on time with APplus finance and accounting: With shorter routine work, lower process costs and simplified accounting methods. The essential basic payroll data is updated automatically, including health insurance and premium rates.

Additional features include the ability to reverse transactions for completed pay periods up to 48 months later and the user-friendly quick entry for HR master data. The integrated official reporting provides ready-to-send forms for government agencies.

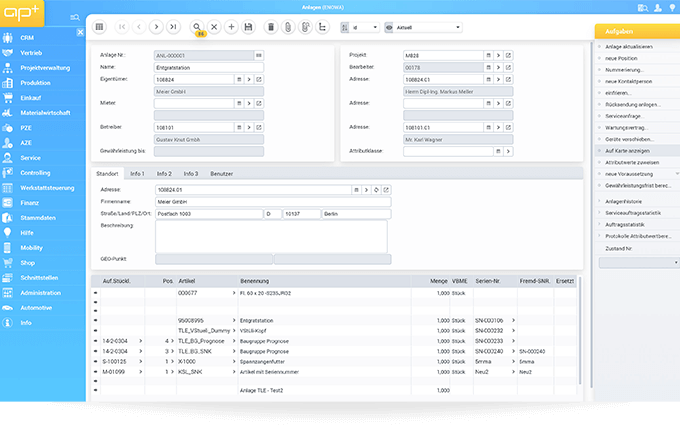

Asset management

APplus's assets accounting module provides an accurate overview of a company's assets at any given time. The definition of depreciation methods is being continuously subjected to increasing demands. Medium-sized companies also must increasingly come to terms with new depreciation and accounting rules (IAS, US GAAP). APplus asset accounting offers the necessary system support for this purpose, including flexible consolidation options in a group of companies. Other helpful features include the ability to simulate various depreciation methods and their effects on company results.